Paid Time Off Shouldn't Be This Hard

Stop wrestling with spreadsheets. Learn how to calculate PTO accrual using clear methods and real-world examples that make sense for your business.

Dan Robin

Calculating paid time off always feels like a chore nobody signed up for. One minute, it seems simple. The next, you're staring at a spreadsheet at 10 PM, wondering if your part-time barista earned 2.1 or 2.3 hours of leave this week. We’ve all been there. It’s a recurring headache that pulls you away from the work that actually matters.

Here's the thing: it doesn't have to be this way. We’ve spent years helping thousands of teams—from bustling retail stores to critical healthcare clinics—get this right. We’ve seen what works, what breaks, and we’re here to share the straightforward approach.

Why getting this right matters so much

Let’s skip the corporate jargon. PTO isn't just a number in a payroll system; it's a promise. It’s the trust you place in your team to rest and recharge. Getting the math wrong, even by a little, breaks that trust. Instantly.

Think of this as your guide to making one of the most important parts of your company culture—time off—fair, clear, and easy for everyone.

A great place to start is with hourly accrual. It's especially fair for teams with shifting schedules, where a steady 40-hour week is a fantasy. It works like this: if you offer 15 days of PTO a year, that’s 120 hours (15 days x 8 hours/day).

Divide that by the standard 2,080 work hours in a full-time year. The result is your accrual rate: 0.0577 hours of PTO for every hour someone works. That means a warehouse employee who puts in a full 40-hour week earns 2.3 hours of PTO. Simple. It’s fair because it ties the benefit directly to the work. For more on the basics, ADP's guide on PTO accrual is a solid resource.

What we're going to cover

We’ll walk through the main ways to calculate accrual, explain why you might pick one over the other, and show you how to set up a system that practically runs itself. No more late-night spreadsheet sessions.

Here’s the plan:

How to handle accruals for both hourly and salaried staff.

The real pros and cons of different calculation methods.

Simple ways to manage caps, carryover rules, and tricky state laws.

Which tools can automate this whole mess, so you can get back to your real job.

Calculating PTO Accrual Per Hour Worked

If you manage a team where schedules change week to week, this is your method. Think retail, hospitality, healthcare—the real world, where a rigid 40-hour week is a myth.

Tying PTO directly to hours worked is the fairest way to do it. It ensures that everyone, from the part-time student working 20 hours to the full-time manager pulling 45, earns their time off in direct proportion to their contribution. It’s transparent. It just makes sense.

The only formula you need

Let’s get the math out of the way. It’s refreshingly simple.

(Total Annual PTO Hours) ÷ (Total Annual Work Hours) = Accrual Rate Per Hour.

This single number becomes the quiet engine of your PTO policy. For every hour someone is on the clock, they earn a small, specific fraction of paid time off. It happens in the background with every single shift.

This isn't just about math; it's about building trust. When your team sees that their time off is directly linked to their effort, it reinforces a culture of fairness. No one feels shortchanged.

Putting it into practice

Let's look at how this plays out. The beauty of this method is how it adapts to different work patterns without any extra effort on your part.

Example 1: The Full-Time Warehouse Manager

Annual PTO: 15 days, which is 120 hours (15 days x 8 hours/day).

Annual Work Hours: A standard 2,080 hours (40 hours/week x 52 weeks).

Calculation: 120 PTO hours ÷ 2,080 work hours = 0.0577 PTO hours earned per hour worked.

If this manager works a standard 80-hour pay period, they accrue 4.616 hours of PTO (80 x 0.0577). Steady. Predictable.

Example 2: The Part-Time Barista

Annual PTO: Same policy, 120 hours.

Annual Work Hours: Averages 20 hours a week, so 1,040 hours a year.

Calculation: The accrual rate is the same for everyone: 0.0577.

If the barista works 45 hours during a busy two weeks, they accrue 2.59 hours of PTO (45 x 0.0577). If the next period is slower and they only work 30 hours, they accrue 1.73 hours. The system is equitable because it’s based on actual time worked.

The overtime question

Here’s a question we see all the time: Should PTO accrue on overtime hours?

Legally, the Fair Labor Standards Act (FLSA) doesn't require it. Our opinion is clear: no, it shouldn’t. PTO is a benefit for rest based on a standard workload. Including overtime complicates things and creates weird incentives.

The key is to be explicit. Your handbook should say something like: “PTO accrues on all regular hours worked, up to 40 hours per week, and does not accrue on overtime hours.” This one sentence prevents a world of future confusion.

This method gives you precision, especially where part-timers make up a big part of your team—nearly 27% of the U.S. workforce. For a company offering 120 hours of annual PTO to someone working 2,000 hours, the rate is a clean 0.06 PTO hours per hour worked. If they log 35 hours, they bank exactly 2.1 hours. It’s proportional and fair. You can explore more on these different PTO tracking methods to see what fits your team best.

Ultimately, calculating PTO per hour is a decision to prioritize fairness. That builds a foundation of trust that pays off far beyond the numbers on a pay stub.

Calculating PTO Per Pay Period: A Simpler Way

For salaried employees or anyone with a consistent schedule, tracking PTO hour-by-hour is overkill. It’s unnecessarily granular. A much cleaner method is to award PTO with every pay period.

This approach lines up with your payroll cycle, creating a predictable rhythm for everyone. It ties the benefit directly to the paycheck, which simplifies your life and gives your team a clear view of their growing time off. You’re trading tiny, constant calculations for a simple, recurring deposit of time.

The formula for rhythm and simplicity

Let's be honest—no one wants to mess with complicated math every two weeks. The beauty of this method is its directness. You set it up once, and it just works.

The formula is as simple as it gets: Total Annual PTO Hours ÷ Number of Pay Periods Per Year = PTO Accrued Per Period

That’s it. No more tracking individual hours. Just a consistent accrual that lands in your team’s PTO bank like clockwork. This is the go-to for salaried office teams, but it also works for anyone with consistent shifts.

This is about more than making your accounting easier. It's about creating a benefit that feels tangible and reliable. When an employee knows they’ll earn exactly X hours of PTO with every paycheck, they can plan their lives with confidence.

How pay frequency changes the math

The only variable here is how often you run payroll. Your pay frequency dictates the number of pay periods, which changes how much PTO is awarded each time.

Let's take a salaried employee who gets 15 PTO days a year, which is 120 hours.

Here's how that breaks down:

Pay Frequency | Pay Periods Per Year | PTO Hours Accrued Per Period |

|---|---|---|

Weekly | 52 | 2.31 hours |

Bi-Weekly | 26 | 4.62 hours |

Semi-Monthly | 24 | 5.00 hours |

Monthly | 12 | 10.00 hours |

The annual total is the same, but the amount doled out each payday shifts. An employee on a bi-weekly schedule knows they’re earning just under half a day off every paycheck. Someone paid monthly sees a bigger chunk, but less often. This consistency makes it easy for everyone to plan.

A quick word on bi-weekly vs. semi-monthly

Here’s a small detail that trips people up: the difference between bi-weekly and semi-monthly payroll. It seems minor, but getting it wrong can throw off your entire calculation and erode employee trust.

Bi-weekly is every two weeks, which means 26 pay periods a year. Semi-monthly is twice a month (e.g., the 15th and 30th), which always means 24 pay periods.

That two-period difference matters. If you use the wrong number, you're either shorting your employees or giving them too much time off. Double-check your payroll schedule and use the right number from the start.

If you find yourself managing formulas for your whole team, using Copilot in Excel might help streamline things. And for a deeper look at the tools that can automate this, check out our guide on https://pebb.io/insights/employee-pto-tracking.

Navigating Caps, Carryover, and State Laws

Figuring out your accrual rate is a great start, but it’s only half the story. The real character of a PTO policy comes from the rules you build around it—accrual caps, carryover rules, and the messy patchwork of state and local laws.

Think of it this way: your accrual rate is the engine, but these rules are the guardrails. Without them, you risk creating a financial headache for the business and a source of confusion for your team. This isn’t about being restrictive; it’s about being clear, fair, and responsible.

Why you need an accrual cap

I’ve seen it happen again and again: unchecked, PTO balances can swell into a huge financial liability. An employee might hoard years of vacation time, and when they leave, the company is on the hook for a massive payout. This isn't just an accounting problem; it often means your people aren't taking the breaks they need.

This is why an accrual cap is so important. It’s a ceiling on the total PTO an employee can have in their bank.

A common and sensible approach is to set the cap at 1.5x the employee's annual PTO. For someone earning 120 hours a year, their balance would stop growing at 180 hours. This gently nudges them to use their time, which helps prevent burnout and keeps liabilities in check.

This isn’t about punishing savers. It’s about building a culture where rest is actually valued. A cap sends a clear message: we want you to use this time. It’s here for you to recharge, not to become a line item on a balance sheet.

The great carryover debate

Once you have a cap, the next question is what happens at year-end. Can employees carry over their unused time? This is where your company’s philosophy on work-life balance really shows.

You have a few options:

Use-It-or-Lose-It: This forces employees to use their PTO by a deadline, or it disappears. While it encourages breaks, it can feel punitive and is illegal in several states, including California and Colorado, where accrued PTO is considered earned wages.

Limited Carryover: A more balanced approach. You let employees roll over a set amount of time (say, 40 hours) into the next year. This offers flexibility for planning bigger trips without letting huge balances build up.

Unlimited Carryover (with a cap): The most flexible model. Employees carry over as much time as they want, but they'll stop accruing new PTO once they hit the overall cap. It puts a lot of trust in your employees to manage their own time.

The right choice depends on your culture. Are you trying to foster flexibility, or do you need to push people to take breaks? Your carryover rule is a powerful tool for shaping that behavior.

State and city laws are non-negotiable

Here’s the thing you absolutely can’t forget: your PTO policy doesn’t exist in a vacuum. It’s governed by a web of state and even city-specific labor laws. What’s legal in Texas might get you in serious trouble in California.

For instance, states like California, Nebraska, and Montana consider accrued vacation time to be earned wages that can't be forfeited. This effectively outlaws "use-it-or-lose-it" policies there. Other states have rules about paying out unused PTO when an employee leaves. It's a complex landscape.

This isn't formal legal advice, but it is a strong recommendation: do your homework. Before you finalize anything, you must consult with a legal expert or an HR advisor who knows the laws where your employees live. A generous, compliant policy is a cornerstone of a healthy business, and a well-defined policy and procedure manual can help get everyone on the same page.

Building Your Policy and Choosing Your Tools

You’ve done the math. The formulas are sorted. Now comes the part that really matters: making it real for your team without creating an administrative nightmare.

This is about implementation. It’s where a good PTO system either becomes a seamless part of your culture or a constant source of friction. A well-written policy and the right tools are what hold everything up.

Putting your policy into words

Clarity is everything. Your employee handbook is the place to turn your calculations into a clear, simple promise. My advice? Ditch the legalese. Write it like you’re explaining it to a new hire, because you are.

Here is some sample language you can adapt. The key is to be direct and cover all the essentials.

Sample Policy Language "Paid Time Off (PTO) is earned on a [per hour worked / per pay period] basis. Full-time team members are eligible for 120 hours of PTO per year. This time is for you to use for vacation, personal needs, or sick days. Your PTO balance will stop accruing once it reaches a maximum of 180 hours (1.5x the annual amount). You may carry over up to 40 hours of unused PTO into the new calendar year."

In a few sentences, that answers the most critical questions: how PTO is earned, how much is given, what it’s for, the cap, and the year-end rule. No ambiguity.

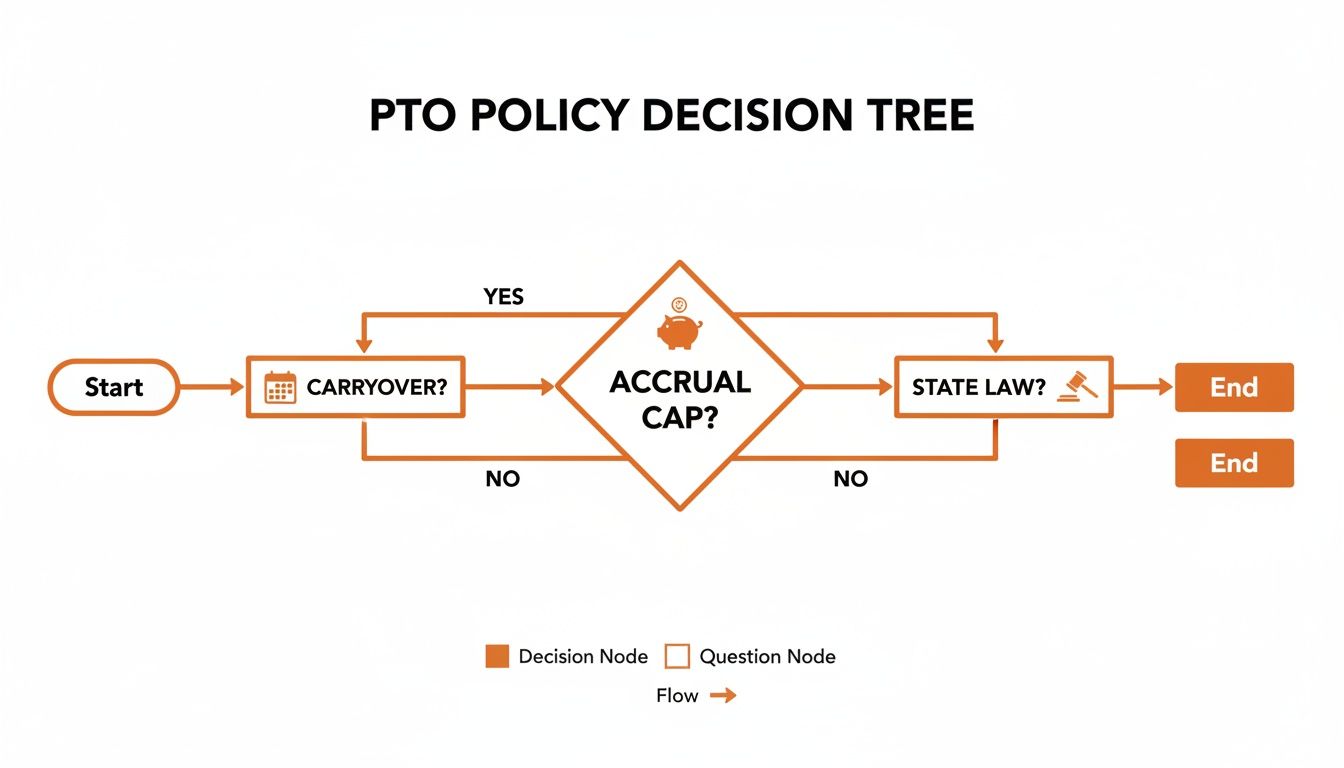

This simple decision tree can help you visualize the key questions to answer as you build out your own policy.

As the flow shows, every decision—from setting a cap to defining carryover—has to be viewed through the lens of compliance with state and local laws.

Ditching the spreadsheet for smarter tools

Let’s be honest. For a tiny team, a spreadsheet can work. But it’s a fragile system. I've seen it break countless times. One broken formula, and suddenly your numbers are wrong. As soon as you grow, that spreadsheet becomes a liability.

The real leap forward is moving from manual tracking to an automated tool. This isn’t about chasing fancy tech; it’s about saving time and eliminating human error.

A modern work app like Pebb is built to handle this. You set your accrual rule once—whether it's 0.0577 hours per hour worked or 4.62 hours per pay period—and the system takes over. It automatically updates balances. No more manual calculations. Ever.

But automation is only half the story. The real power comes from putting information directly into your team’s hands.

For Employees: They can check their PTO balance anytime, from their phones. They see what they’ve earned and can request time off in seconds.

For Managers: They get a notification, see team availability, and can approve requests on the spot. It all happens in the same place they manage schedules.

This is how you turn a complex calculation into a simple, trusted part of your daily operations. You stop being the keeper of the numbers and instead become the steward of a system that just works. If you're considering your options, we've put together a guide on some of the best employee PTO tracker tools available.

Ultimately, a great PTO system isn't just about the math. It's about designing a process that feels fair, transparent, and effortless for the people who rely on it.

Answering Your Team's PTO Questions

Set up a few dozen PTO policies, and you start hearing the same questions. These are the practical puzzles that pop up long after you’ve picked your accrual method. I've wrestled with these myself, so let's walk through the most common ones.

Should PTO accrue on overtime hours?

This is a great question. It cuts to the core of what paid time off is all about.

The short answer? No. Legally, you're not required to. The Fair Labor Standards Act (FLSA) doesn’t mandate it, so you're on solid ground.

But beyond the law, it's a matter of philosophy. PTO is for a break from a standard work schedule. Tying it to overtime not only complicates the math but creates a weird incentive—rewarding overwork with more time off. That’s a strange paradox to build into your culture.

The key is just being clear about it in your policy. A simple sentence is all it takes:

"PTO accrues on all regular hours worked, up to 40 hours per week, and does not accrue on overtime hours."

That one line leaves no room for confusion.

What's the difference between front-loading and accruing PTO?

Think of it like getting a gift card versus earning store credit.

Front-loading is the gift card. You give employees their entire annual PTO allowance in one big chunk, usually on January 1st or their work anniversary. An employee logs in and sees their full 120 hours ready to use. Clean and simple.

Accrual, which we've been talking about, is the store credit. It’s a gradual process of earning time off with each pay period or hour worked. This ties the benefit directly to an employee's time with the company.

So which is better? It comes down to risk. With front-loading, if someone uses all 15 of their vacation days by February and then quits in March, you've essentially paid for a benefit they haven't fully "earned" through service. Depending on state laws, you might not get that money back.

Accrual feels more balanced. It aligns the benefit with tenure, which is often a safer bet for the business.

How should we handle negative PTO balances?

It’s going to happen. A family emergency pops up, and an employee needs a day off they haven't earned yet. How you handle this says a lot about your culture.

Some companies have a strict "no negative balances" rule. It’s clean, but it can feel rigid when real life intervenes.

A more flexible approach is to let managers approve a negative balance up to a certain limit, like -40 hours. The employee then earns their way back into the positive over the next few pay periods. It shows you trust your people.

If you go this route, your policy must be explicit about what happens if an employee leaves with a negative balance. Most policies state that any negative PTO will be deducted from their final paycheck, provided it’s legal in your state. Whatever you decide, apply the rule consistently.

Managing PTO shouldn’t be a headache. It should be a seamless part of building a great place to work. Tools like Pebb can bring everything together—PTO, scheduling, communication—into one simple app. It turns all these complex calculations into an automated, transparent process, giving your team clarity and your managers some peace of mind.