A Calm Guide to Calculating PTO Payout

Learn how to calculate PTO payout with our clear, human guide. We cover the formulas, state laws, and common mistakes to help you get it right every time.

Dan Robin

Let's be honest. Calculating a final paycheck with unused PTO feels less like simple math and more like navigating a maze. It’s a high-stakes moment for everyone. The person leaving is anxious about their final check, and whoever is running payroll is double-checking everything, hoping they got it right.

This isn't just about plugging numbers into a spreadsheet. It’s about ending a professional relationship on a note of fairness and respect. I’ve been on both sides of this equation, and it’s a process often bogged down by legal jargon, confusing internal policies, and the very real fact that this is someone's livelihood.

The whole thing is an exercise in trust. And getting it wrong erodes that trust instantly.

Why PTO Payouts Get So Complicated

The math itself is easy. It’s everything else that creates the mess. The real complexity comes from a few places that love to overlap, creating a perfect storm of confusion. Getting this right is what separates a smooth, professional offboarding from a lingering headache of compliance issues and broken trust.

Here’s why things get so tangled:

A Patchwork of State Laws: There's no federal law that says you have to pay out PTO. It's a state-by-state affair. Some states, like California and Illinois, see accrued vacation as earned wages that must be paid out when someone leaves. Others leave it entirely up to your company policy. A perfectly legal approach in Texas could get you into trouble in Colorado.

Vague Company Policies: If your employee handbook is fuzzy on how PTO is earned, carryover limits, or what happens at termination, you're setting yourself up for a fight. Ambiguity is the enemy of a clean exit.

The Tax Question: A payout isn't a direct transfer. It’s taxed as supplemental income, which often surprises employees when their take-home pay is lower than they expected. For a deeper dive, understanding the bonus tax rate can clarify how this works.

The real challenge isn’t the calculation—it's ensuring the numbers are based on fair policies and solid legal ground. It's about setting clear expectations long before an employee’s last day.

Ultimately, your goal should be to make this process predictable and transparent. A clear, well-communicated policy transforms a potentially contentious event into a routine administrative task. It protects your business, preserves goodwill, and makes sure there are no nasty surprises waiting for anyone.

The Core Formulas for Calculating Payouts

Alright, let's get down to the actual math. The fundamental concept is always the same: Final Rate of Pay × Unused PTO Hours = Gross Payout Amount. The trick is figuring out that "final rate of pay," which changes depending on how you pay people.

For Hourly Employees

This one is as straightforward as it gets. Your hourly folks already have a set wage, so you have the main number you need.

You just multiply their hourly rate by the number of PTO hours they've banked.

Let's take a real-world example. Imagine Alex, a part-time retail associate.

Alex earns $18.00 per hour.

When they leave, they have 24 hours of unused PTO.

The math is simple: $18.00 × 24 hours = $432.00.

That $432.00 is Alex’s gross PTO payout before any taxes are taken out. No complications. For salaried employees, however, we need to do a little prep work.

For Salaried Employees

The key difference here is that salaried employees don't have a pre-set hourly rate, so you have to calculate one. Your goal is to convert their annual salary into a reliable hourly equivalent.

The most common and dependable way to do this is to use a standard 40-hour workweek spread across 52 weeks.

Salaried Hourly Rate = Annual Salary ÷ 2,080 (Where did 2,080 come from? It's 40 hours/week × 52 weeks/year.)

Let’s look at Maria, a full-time manager.

Maria’s annual salary is $75,000.

First, we find her hourly rate: $75,000 ÷ 2,080 = $36.06 per hour.

She has 80 hours of unused PTO.

Now, we calculate the payout: $36.06 × 80 hours = $2,884.80.

That conversion step is crucial. Without it, you’re just guessing. Once you have that hourly equivalent, the rest of the calculation is the same as for an hourly employee.

To make things even easier, here's a quick reference.

PTO Payout Calculation Formulas at a Glance

Employee Type | Calculation Formula | Example Variables |

|---|---|---|

Hourly | Hourly Rate × Unused PTO Hours |

|

Salaried | (Annual Salary ÷ 2,080) × Unused PTO Hours |

|

Having a clear, repeatable formula removes any guesswork. It gives you confidence that every calculation is fair, consistent, and legally sound.

While PTO is the focus, be aware of other potential entitlements. In some regions, other payouts might apply. For instance, tools like an Ontario severance pay calculator can help you understand related obligations.

Mastering these simple formulas turns a tricky task into a predictable one.

Navigating State Laws and Company Policies

Knowing the formulas is a great start, but let’s be real—that’s only half the story. The other half is navigating the tangled web of state laws and your own company policies. This is where even well-intentioned businesses get into trouble.

It's a complete patchwork out there. No federal law says you have to pay out unused PTO when someone leaves. It’s up to the states, and their rules are all over the place. Take California, for example. The state treats accrued vacation time as earned wages that must be paid out. But head to Florida, and the law leaves it entirely up to the employer.

This is why your company’s internal policy is more than just a document—it's a promise. Once you put it in writing, it can become a binding agreement. A vague or unclear policy is an open invitation for misunderstandings and legal headaches.

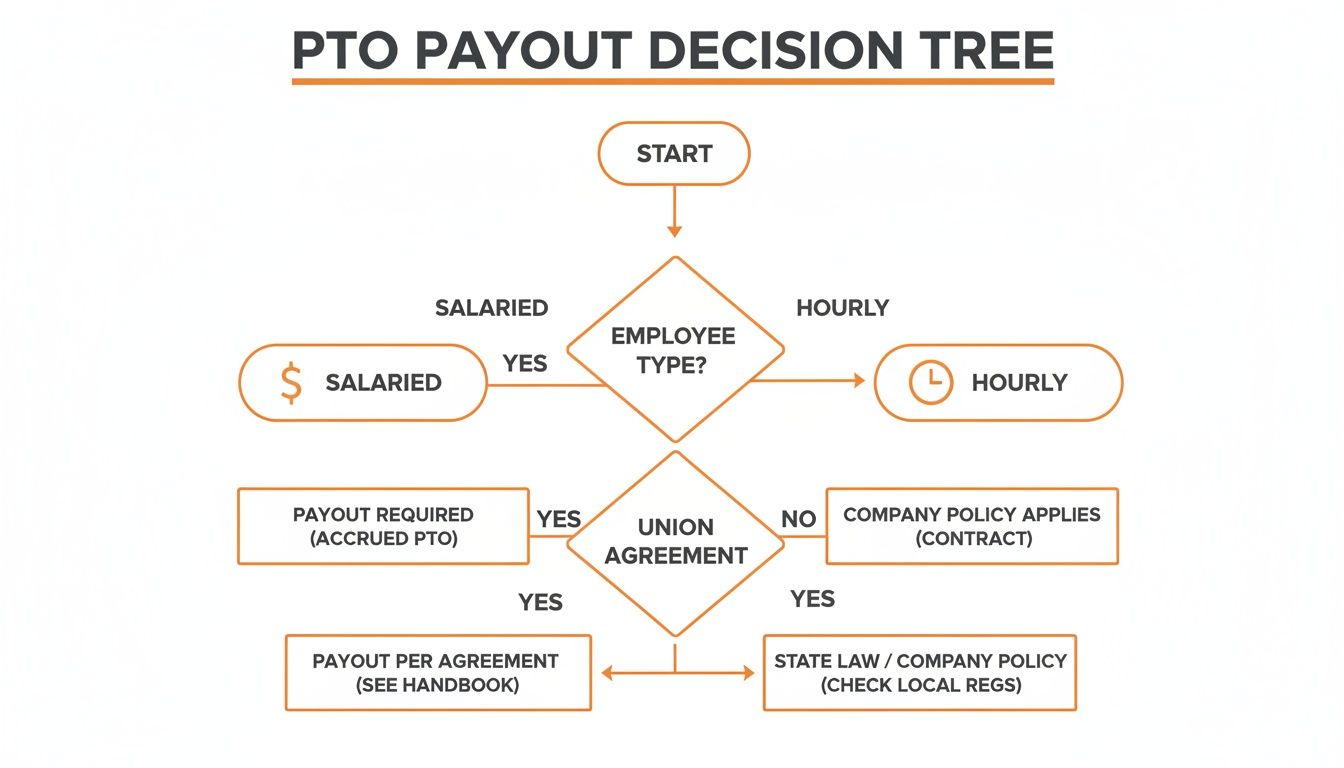

To help you get started, here's a simple decision tree that breaks down the first few steps.

As you can see, the first move is always to figure out the employee's status. That simple step sets the stage for everything else.

Your Handbook Is Your First Line of Defense

A crystal-clear policy protects everyone. It sets fair expectations and gives your team a reliable guide. Your policy should spell out exactly how PTO is earned, if there are accrual caps, and what happens to unused time when someone leaves—whether they quit or are let go.

Your employee handbook is the single most important tool for avoiding disputes. If it’s not in writing, it’s open to interpretation, and that’s a risky place to be.

I’ve seen it happen. A company with a casual, unwritten "use-it-or-lose-it" policy gets challenged by an employee in a state where that’s not allowed. The result? A payout far bigger than they expected, plus potential fines. Clarity is your best insurance policy. For a deeper dive, check out our guide on creating an effective policy and procedure manual.

Only about 20% of U.S. states require employers to pay out unused vacation time. The rest defer to company policy, creating a massive gray area where your rules become the final word. This isn't just about compliance; it's about doing the right thing. A well-defined policy ensures every payout is not just mathematically correct but also legally and ethically sound.

The Problem of Unused PTO

Before we go any further, let’s tackle a bigger question: Why do your employees have so much unused time off to begin with? Think of it this way—every hour of PTO an employee banks is a financial IOU from the company. It’s an invisible, growing liability sitting on your balance sheet.

This isn't just an accounting headache; it's a huge red flag about your company culture. We've all been in workplaces where taking a real vacation felt... frowned upon. No one said it out loud, but the unspoken message was clear. Managers never logged off, workloads were crushing, and the fear of coming back to an avalanche of work was very real.

This "PTO hoarding" isn't a minor quirk. It points to a serious disconnect between the benefits you offer and the daily reality of your work environment. When people don’t take breaks, burnout is just around the corner, and that hidden PTO liability keeps swelling.

The Financial Weight of Unused Time

The scale of this problem is massive. American workers leave an estimated $52.4 billion in unused vacation benefits on the table every year. To make matters worse, nearly half of all employees expect to forfeit some of their time. That’s a staggering amount of unclaimed value, and it creates a significant financial burden for businesses.

This reveals a fundamental breakdown. You offer PTO for rest, yet the culture discourages using it. It’s a paradox that hurts both your people and your bottom line.

Unused PTO isn't a sign of dedication; it's a symptom of a culture that prioritizes constant availability over sustainable performance. That liability on your books is a direct reflection of your team's well-being.

Shifting from Reactive to Proactive

So, what’s the real lesson? The goal shouldn't be to get better at cutting a final check. The real goal is to build a culture where big payouts are rare because your team feels supported in taking time off.

This change starts from the top. It means managers leading by example and actually taking their own vacations. It means honest conversations about workload and making sure there’s proper coverage when someone is out.

It also means having clear, supportive rules. You can get some great ideas from these attendance policy samples.

By shifting your focus from managing the payout to actively encouraging time off, you do more than shrink a line on your balance sheet. You build a healthier, more resilient team. That’s an investment that pays dividends long after the last paycheck is cut.

Making PTO Management Simple and Human

So, how do you ditch the clunky spreadsheets and constant legal worries for a PTO system that just works? The answer isn't another layer of complexity. It's about weaving PTO management right into the daily flow of work. Tools should make life easier, not add another chore.

Imagine your team seeing their accrued PTO balance right inside the app they use to check their schedule. No more mystery. No more back-and-forth with HR to ask a simple question. It’s about creating a single source of truth that connects everything seamlessly.

When an employee decides to move on, their accrued hours are already there—transparent and ready for payroll. This clarity transforms a potentially tense process into a respectful, final step.

Building Trust Through Transparency

Let’s be honest: the confusion around PTO often hits hourly and frontline workers the hardest. The numbers can vary wildly depending on the industry. While the U.S. average might be around 10-20 vacation days, service industries often offer just 5-10 days, especially for part-timers. This can lead to tiny payouts and frustration. You can dig into these PTO day averages for 2025 and see just how much they differ.

This is where a unified platform makes a huge difference. By putting PTO balances right in employee profiles, you get rid of the guesswork. Everyone sees the same numbers, which stops disputes before they start.

When the system is transparent, trust follows. People stop seeing PTO as some mysterious benefit controlled by HR and start seeing it as their earned time, managed with total clarity.

A Clear Policy Is Your Foundation

Of course, even the best tool can't fix a broken policy. Having a clear, well-communicated approach to PTO is essential. It needs to be spelled out in simple terms and be easy for everyone to find.

If you're looking to solidify your approach, our guide on how to create an employee handbook is a fantastic place to start. A solid handbook provides the foundation that great tools can then bring to life.

Ultimately, simplifying PTO management isn't just about making administration easier. It’s about treating people with respect, providing clarity, and building a culture where everyone—from their first day to their last—feels they’ve been treated fairly. It’s about making the whole process feel less transactional and a lot more human.

Frequently Asked Questions About PTO Payouts

Let's face it, even with the clearest policies, paid time off gets complicated. Certain questions pop up time and again when you're handling a departing employee's final check.

These aren't just minor details; they're the real-world snags that can cause major headaches. Let's walk through a few of the most common ones.

Do We Have to Pay Out Unused Sick Time?

This one trips up a lot of people. The answer almost always boils down to a combination of state law and your own company handbook.

Most states that mandate PTO payouts are talking specifically about vacation days or a combined PTO bank. Sick leave is often treated as a separate category. For example, if you offer 10 vacation days and 5 sick days, you're likely only on the hook for the vacation time.

But here's the catch: if you lump it all together into a single bank of 15 "PTO" days, the game changes. In that case, those days are usually considered earned wages and have to be paid out. The key is how you've defined and separated the different types of leave in your policy.

How Are PTO Payouts Taxed?

It’s important to get this right: a PTO payout is not a tax-free bonus. It's earned income. The IRS views these payments as supplemental wages, which means they're subject to federal, state, Social Security, and Medicare taxes.

You generally have two ways to handle the withholding. You can withhold a flat 22% federal tax, which is how many businesses handle bonuses. Or, you can add the payout to the employee's final paycheck and tax the entire amount at their normal rate. This choice can make a real difference in their take-home pay, so being transparent about it is the best way to avoid surprises.

Think of a PTO payout as an accelerated final paycheck, not a gift. It’s taxed just like any other dollar earned, a detail that often gets overlooked.

Can We Have a "Use It or Lose It" Policy?

Whether you can have a "use-it-or-lose-it" policy is entirely up to your state. Some states, like California and Nebraska, have banned them completely. Their reasoning is that accrued time off is an earned wage, and you can't force an employee to forfeit something they've already earned.

Even in states where these policies are legal, you still have to give your team a reasonable chance to actually use their time before it expires. A much safer approach is setting a carryover cap. This lets employees roll over a certain number of unused hours to the next year, which helps you manage financial liability without stepping on any legal landmines.

Managing PTO shouldn't require a law degree and an accounting certificate. Pebb brings everything from scheduling and team chat to PTO tracking together in one dead-simple app. When your team can see their accrued time in the same place they check their shifts, it builds trust and makes offboarding a simple, clear, and human process. Learn more at pebb.io.